Nothing less than the second best: why we transfer income

Income transfers are out of fashion across the political spectrum. Egalitarians, we are told, have been fooled into treating the symptoms of economic inequality rather than the causes, subsidising low wages rather than tackling inequality in the primary distribution of income (the distribution before taxes and benefits). Meanwhile the right-wing project of stigmatising recipients of income transfers storms ahead, with the public seemingly all too happy to accept a narrative that blames our economic and fiscal woes on a passive underclass of welfare scroungers. Labour's communitarians reject the stigma but fully endorse the notion that transfers, other than those based on prior contribution, are fundamentally demoralising. Meanwhile, pragmatic commentators argue that transfers suffer from a legitimacy deficit in public opinion compared to publicly funded services .

I'd go along some of the way with some of these lines of argument, but not as far their conclusions. Much of the criticism of income transfers seems to me to be missing the wrong target by assuming that the extent of income transfers is a useful indicator of social and economic failure. Thus if we are transferring £25bn in income through tax credits, this is because of low wages: ignore the fact that most low-paid workers are not in low income households, and that tax credit entitlement is based on family size as well as income. Similarly, the billions transferred through housing benefit are due to excessive private sector rents driven by failure to build enough new houses, at least as long as we pass over the fact that social housing accounts for the bulk of the transfer. If public expenditure on disability benefits is rising, this is because we aren't doing enough to help disabled people earn a living- even though the benefit in question, DLA, is not an out of work benefit. Thus every expenditure total seems to come with a causal explanation framed in terms of failure. Ed Miliband's recent speech on social security - which was notable in taking a far more positive tone than most current political discourse- nonetheless endorsed all of these causal explanations.

There are many valid (and many more tendentious) criticisms to be made of social security systems, but with cash transfers equivalent to 14% of GDP across western nations, and to 6% of GDP excluding old age benefits1, and with the UK at the lower end of the expenditure league, is it really plausible that most of this (modest) redistribution represents the easily avoidable 'costs of social failure', to use one of Tony Blair and Gordon Brown's phrases? It is worth reminding ourselves why welfare states transfer incomes at all. This is not primarily in order to reduce inequality, as some egalitarian theorists seem to assume, but to reduce poverty. It is true that if poverty is conceived in relative terms rather than as falling below some 'absolute' subsistence level, reducing poverty entails reducing inequality (on some, not all, measures2). But this inequality reduction is a by-product of poverty reduction. And not all poverty is attributable to social failure.

We have known this for a long time. Beveridge's vision of a welfare state (a term he hated) turned on the recognition that working people faced high risks of poverty at particular stages in the lifecycle - when they had young children to support, and when they were too old to work. But the recognition of lifecycle risks long preceded Beveridge. Remember that Thomas Paine proposed old age pensions and family allowances in the second part of 'The Rights of Man' in 1792. At the same time, Paine's contemporary and occasional collaborator Condorcet (the source of the phrase 'l'art social' by the way) was developing early plans for social insurance to deal with temporary and permanent incapacity to work for a living. Thus the problems postwar welfare states sought to address were with us, and were recognised, even before the industrial revolution. Why, in a post-industrial world, should we expect them to have disappeared? Lifecycle poverty risks and sickness and disability remain the major calls on social security budgets today.

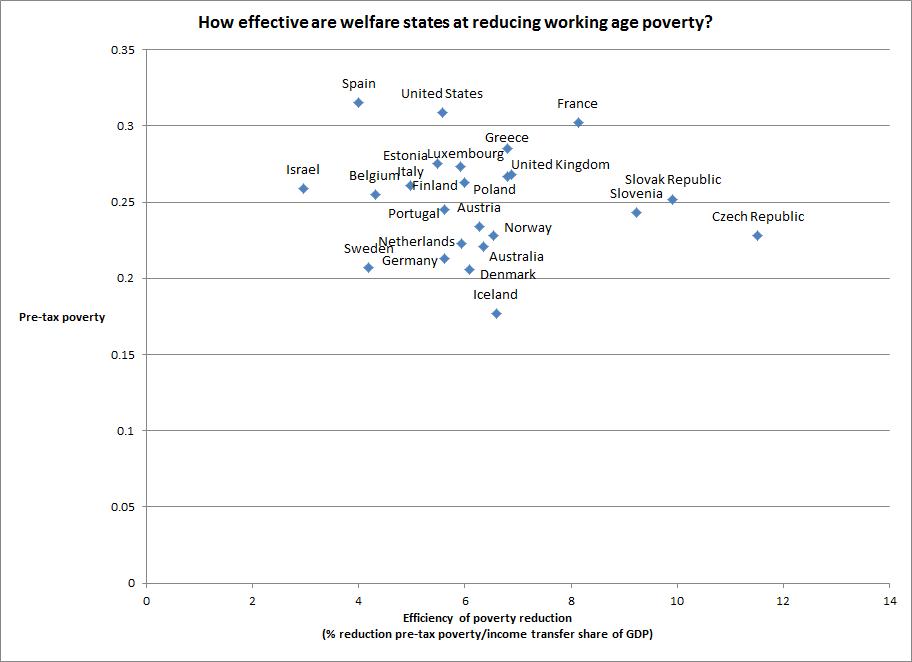

It sometimes seems to be assumed that with rising living standards and improvements in health status, we don't need to worry so much about these risks any more. But take a look at the chart, which shows new OECD data on working age poverty before taxes and benefits. The vertical axis on the chart shows where different countries stood in terms of pre-tax-and-transfer poverty in 2010. The UK has one of the higher poverty rates in the sample, but what is really striking is that all of these countries with the exception of Iceland show pre-tax working age poverty rates of more than 20%. This includes the other Nordic countries with which the UK is so often compared to its disadvantage. This is not just the effect of the economic downturn: most countries had poverty rates above 20% in 2005. (The poverty threshold here is 60% of median post-tax income: using a 50% threshold gives a rather different ranking).

All of these countries also reduce working age poverty by transferring income, but to very different extents. Transfers (excluding pensioner benefits) in the UK amount to 5.7% of GDP, compared to 3.6% in the United States and 10.2% in Belgium. The UK transfers about the same (in terms of GDP) as Sweden, a little less than Norway or the Netherlands.The extent to which these transfers reduce poverty ranges from 15% in Israel and 20% in the United States to 48% in Slovenia and 59% in the Czech Republic, with the UK's 5.7% of GDP buying a 39% reduction in poverty. The horizontal axis of the chart measures the efficiency of these transfers in reducing poverty by dividing the percentage reduction in working age poverty by the share of transfers (excluding to pensioners) in GDP. There is no particular relationship between 'efficiency' thus defined and either the extent of transfers or the level of pre-tax poverty, but the UK is towards the more efficient end of the spectrum.

We don't have any examples of mature welfare states where working age poverty before redistribution could be regarded as a marginal phenomenon arising from frictional shortfalls in income. The current animus against income transfers thus seems misplaced. Of course the UK's high rate of pre-tax poverty should be a matter for concern, but let's not fool ourselves that this isn't a major problem in all comparable economies. It would be great to reduce housing costs (if this could be done without pain, which is questionable: see Frances Coppola here ). A labour market with higher wages at the lower end and which excludes fewer disabled people is eminently desirable and, international comparison suggests, achievable. But countries with lower housing costs, less wage inequality and better employment outcomes for disabled people still need to engage in substantial transfers of income to reduce poverty risks. Equating these transfers with 'the cost of social failure' is a refusal to recognise that there are risks that will have to be dealt with under any plausible economic and social conditions.

Of course income transfers are not the high road to an egalitarian society: they were never intended to be. It is for other policy instruments to address the factors which drive inequality in the primary distribution of income3. Contemporary egalitarians are right to turn their attention to pre-tax inequality. But to motivate this concern in terms of making major reductions in the need for transfers would be perverse. Ultimately, income transfers are just one of the ways in which we and all other mature welfare states manage some of the risks of a second-best world. Egalitarians, of all people, should be demanding nothing less than the second best.

[1] Averages for OECD countries in 2009, excluding Chile, Japan, Korea, Mexico and Turkey. Source: OECD SOCX database.

[2] This depends on the sensitivity of different inequality measures to what is happening at the extremes of the income distribution.

[3] Although well-designed social security systems can play a role here as well, as the UK experience from the late 1990s to the middle of the last decade showed, and badly designed systems can have negative effects, as the experience of the 1980s and early 1990s shows.

[The title of this article comes from Curtis Mayfield 'Move on Up' http://www.youtube.com/watch?v=6Z66wVo7uNw ]