That obscure object of welfare reform

This week's outbreak of irrationality over welfare has brought home to me just how far political debate on this issue in the UK has broken loose from any mooring in reality. It's obvious that what people refer to as 'welfare' has little to do with the realities of expenditure levels, eligibility conditions, employment impacts, deduction rates or any of the other things that those of us whose job involves trying to understand social security systems worry about. Very little that has been said over the last week has really been about welfare in this sense. Rather, 'welfare' in the UK political imagination is a prism through which issues of class, social cohesion and purported national decline are refracted, magnified and distorted with little reference to the functions of social security or how well it fulfills them. When a former speech-writer to Tony Blair can reduce the entire debate, without any significant loss of nuance, to the headline 'Labour can't win if it's on Mick Philpott's side' http://www.thetimes.co.uk/tto/opinion/columnists/philipcollins/article37... (£) it's time for people like me to bow out and get back to our day jobs.

Turning to the OECD's newly-updated Social Security Expenditure Database (SOCX) after being immersed in this sort of thing is like walking out of a charnel house into fresh air and daylight. Here the researcher can access detailed, consistent information on different social security systems going back to the early 1980's (and even to the early 60's for some data). We can see how expenditure has developed over time by programme, look at the priorities of different systems at different times and test hypotheses about the drivers of expenditure. And we are able to anchor assessments of how systems are performing in historical and international comparison, without which evaluative statements about welfare are essentially contentless. Any politician or commentator can assert that benefits are too generous (or stingy) or spending is too high (or too low). But if you're professionally obliged to offer something more than a venting of your uninformed intuitions, you need points of comparison, which is what SOCX provides. The increased public availablilty of robust international data - not just from the OECD but from other international organisations such as the ILO, the World Bank and Eurostat- has been one of the signal positive developments in welfare state research over recent years.

So how has welfare spending developed over time in the UK, compared to other (comparable) countries? Let's start with a definition of 'welfare' (a step usually carefully avoided in the political debate). I think the SOCX category of 'cash benefits' comes closest to what people mean: 'welfare' doesn't seem to include benefits in kind such as healthcare or social services. And 'welfare' also doesn't seem to include pensions and other benefits for older people, or so I assume from the way politicians use the term, so we can take out the category of cash benefits for the elderly. In some countries, mandatory private insurance plays an important role (the UK isn't one of them), so in order to get accurate comparisons, the relevant expenditure category is 'public and mandatory private social expenditure'. (You can access all the data here and repeat all these steps using the drop-down menus http://stats.oecd.org/Index.aspx?datasetcode=SOCX_AGG# )

Next, which countries provide a valid comparison with the UK? I've opted for 19 western European and majority English-speaking countries. In the attached spreadsheet I've grouped countries together into the standard classification of 'welfare regimes' - continental (also known as 'conservative'), Anglo (also known as 'liberal'), Nordic (or 'social democratic') and Southern European (with Ireland allocated to the 'Anglo' category- some would argue it belongs with Southern Europe[correction!25 April: in the spreadsheet, I dropped Ireland on the grounds that its trends are outlandish and confusing- a judgment based on more than the stats, by the way]). Like many researchers, I don't really know what to do with Switzerland, so I've left it out, and the data for Iceland is unfortunately incomplete. (The analysis in the table is based on the approach in Francis Castles' 'The Future of the welfare State: crisis myths and crisis realities' http://www.oup.com/us/catalog/general/subject/Politics/InternationalStud... which I urge anyone with an interest in these issues to read if they get a chance.)

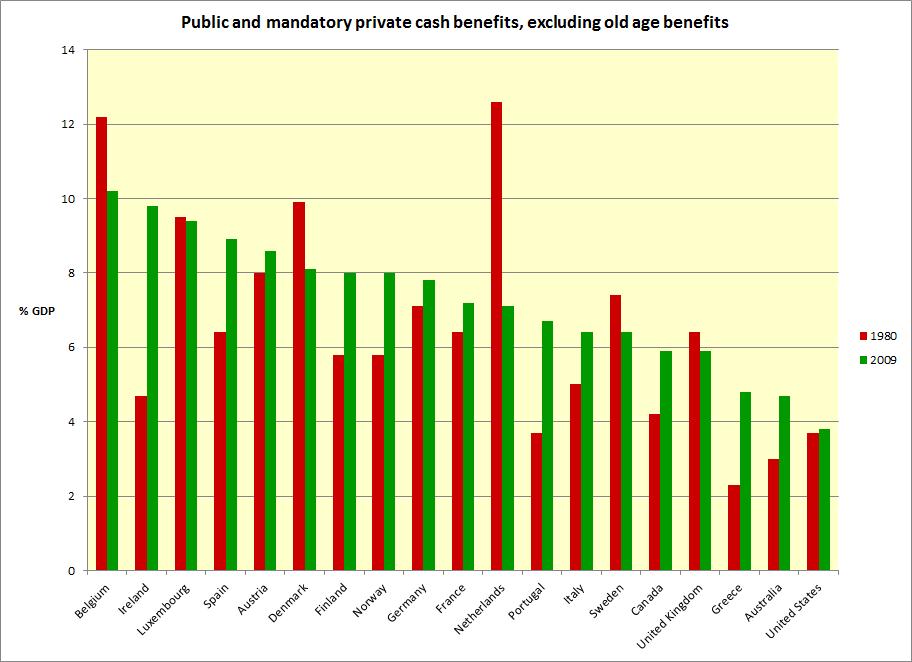

I've charted the data for 1980 and 2009 at the head of this article (2009 is the last year for which SOCX provides the right level of detail). Countries are ranked left to right by their spending level in 2009. This only gives a partial view, and it's really worth looking at the table - for a start, the impact of recession varied a lot between countries, so a fairer comparison of long-term trends might be 2005 compared with 1980. Nonetheless, four important points emerge even from this simple comparison.

• The first is that only three of these countries had lower spending than the UK in 2009, Australia, Greece and the United States. The UK is not a high welfare spender. (In fact, in 2005 spending in the UK and Australia was at the same level, so the impact of recession is affecting the comparison.)

• The second is that spending in the UK in 2009 was lower than spending in 1980. Spending at the moment is not high by historical standards, which won't be news to readers of this blog.

• The third is that while there is a lot of variation in spending, reflecting both institutional differences and the state of national labour markets, eleven of the 19 countries (including the UK) are in a fairly narrow range of just over two percentage points, spending between 5.9 and 8.1 per cent of GDP on working age benefits.The UK isn't a high spender, but it isn't an outstandingly low spender either.

• The fourth is less easy to see in the chart: the amount of variation between countries was a lot lower in 2009 than in 1980. In fact the table shows that cross-national variation (measured by the coefficient of variation at the bottom of the table) reduced by 46% over this period. Welfare states are much more alike in terms of working age spending than they used to be. Some historically low spending countries, including Canada and Australia, have increased spending while some high spenders, notably the Netherlands, have reduced spending. There hasn't been convergence in spending levels across the board: but there has been substantial convergence, and not all of it downwards.

So neither historical nor international comparison supports the standard view that welfare spending in the UK is at a high level. But that polemical point is much less important than some of the other things suggested by the comparisons. The UK does not stand alone in the world. Its labour market, public finances and welfare provision are subject to similar long term pressures to other countries. Some of these pressures are more marked in the UK, some less. But the convergence in working age expenditure that we’ve seen is – I would argue- to a large extent a reflection of common pressures, both economic and fiscal, and of common policy responses. And this raises the question of why people should expect the UK to be able to manage the pressures of 21st century labour markets and economic inequality at lower cost than other comparable countries.

Of course there are choices, as well as hard constraints, in public expenditure. But when we look at developments across countries and over time, does this give the impression that the UK has been exceptionally lavish in its spending over recent years, or that there are obvious expenditure-reducing reforms that the UK has failed to implement? I think not. Those who believe that there is huge scope for cutting working age welfare spending don't seem to be aware of the implications of what they're saying. The United States and Greece are /outliers/ among comparable welfare states (if we regard them as comparable at all). It is hard to see how either offers any kind of model for the future development of UK social security - and the lamentable performance of the US labour market since the turn of the century http://inequalitiesblog.wordpress.com/2012/02/24/the-end-of-the-american... suggests that the main argument for Clintonian welfare radicalism is long past its sell-by date. The problem with the UK welfare debate, to get back to where we started, is that for too long politicians of all parties have convinced themselves that a large share of the expenditure was unnecessary or downright undesirable. Maybe they're right, but they don't convince me, because they offer no argument as to why we should think the UK is special- so it doesn't need to spend as much as other countries - or that the great majority of welfare states are irrationally devoted to unnecessary welfare spending.