There's more to benefits policy than fairness

The government wants to switch to below-inflation uprating of a number of key working age benefits http://www.hm-treasury.gov.uk/as2012_policy_decisions.htm . The opposition points out that this change will have a big impact on working families. http://labourlist.org/2012/12/ed-balls-confirms-labour-will-oppose-tory-... This brings out an under-appreciated aspect of how social security and labour markets have changed over the last twenty years. We now spend a lot more on keeping people in work than we used to.

As I've noted before, spending on working age benefits as a share of GDP is almost exactly the same now as in the recession of the early 1990's http://www.leftfootforward.org/2010/07/the-paradoxical-stability-of-welf... but the composition of spending is very different, with in-work benefits accounting for a much larger share of expenditure.This reflects positive and negative factors (which is which may depend on your point of view): on the positive side are greater support to working families through tax credits, far lower rates of worklessness for families with children- part of which is due to the improved work incentives entailed by tax credits combined with the minimum wage- and lower unemployment. On the negative side there is the declining value of the main out of work benefits (which Jonathan Portes comments on here http://notthetreasuryview.blogspot.co.uk/2012/12/indexing-benefits-to-in... ) which has left the UK with particularly ungenerous support to people without children. There is also more spending on in-work housing benefit as families rely more on the private rented sector- although this is not the main driver of housing benefit growth over the long term. Another factor which has pushed up in-work support since the recession and may also have restrained growth in out of work benefits has been the preparedness of workers to restrain pay demands and to accept cuts to working hours. Tax credits have certainly softened the blow of reduced weekly earnings for many families, and may have made this strategy more viable for workers and firms.

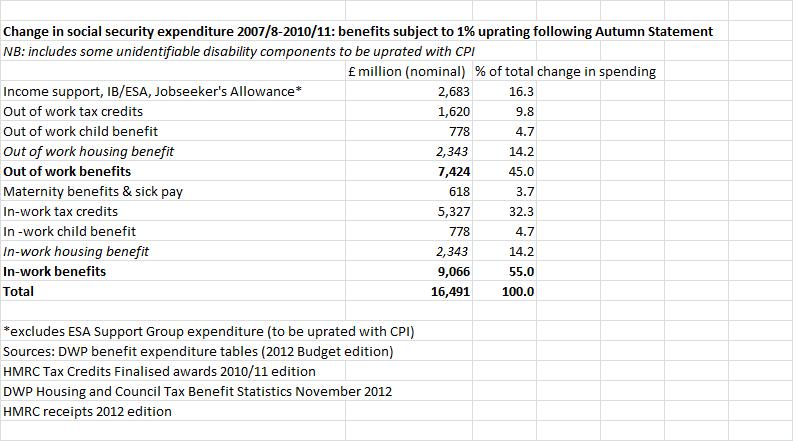

It more or less follows from all this that cuts to social security will have more of an impact on the employed than in earlier periods. The table shows the growth in nominal expenditure on the benefits which have been targeted for below-inflation uprating, as far as I can identify them from the publicly available data*. Even prior to the recession, 40% of spending on these benefits was going to people in employment, and the share accounted for by the employed rose to 43% by 2010/11. Some 55% of the growth in these benefits over this period has gone to working people, as shown in the table. The biggest single component is in-work tax credits, accounting for nearly a third of the overall increase.

So the opposition has a point: below inflation uprating will hit working families. I wish though that rather than framing their opposition to the government's proposals in terms of the 'strivers' versus 'skivers' rhetoric which has served debate so poorly over recent years, they would concentrate more on the positive side of this story. More than half the increase in spending on these benefits since the recession is supporting working families who have 'done the right thing' in adapting flexibly to a fall in demand for labour not of their making: Labour can claim some credit for policies which made this option more feasible and bearable. There's no need for a swipe at those who are struggling on out of work benefits to make that point. Indeed what these figures show is that the Chancellor's framing of the policy in terms of fairness to workers experiencing low earnings growth is something of a fantasy. These benefits provided partial compensation for below inflation earnings increases for many workers. The contrast between 'strivers' and 'skivers' is singularly misplaced in this context.

Finally, Jonathan makes the crucial macro-economic point: 'cutting welfare benefits deliberately negates, as a matter of policy, the operation of the automatic stabilisers; it is a reduction in flexibility, not an increase.' http://notthetreasuryview.blogspot.co.uk/2012/12/the-autumn-statement-an... Below inflation uprating coupled with stagnant labour demand promises more unemployment, not less. To which I'd add that changes to social security over the last twenty years have probably reinforced the stabilising function of benefits with regard to employment. This is one area where, with sensible policy decisions, macro- and micro- levers could be working together to everyone's benefit. Debate on issues like benefit uprating are really not best approached in terms of a zero-sum distributional game, with each side promoting its preferred option in terms of 'fairness'. Personally, I think the proposed uprating is deeply unfair to both working and out of work claimants. But -thankfully!- there's more to social security policy than fairness.

*Technical points: the government has exempted a number of disability elements from the policy, but it is not always possible to separate these out (where I can, I have: I don't think the unidentified elements will make a great deal of difference). I've split the benefits into in- and out of work, and I've allocated Statutory Maternity Pay, Maternity Allowance and Statutory Sick Pay to the in-work benefits category, because that is where they belong. I compare 2007/8 - so before the onset of recession- with 2010/11 (I'd rather have compared 2011/12 but the data on tax credits isn't available yet). For housing benefit, there is no data on in-work claims prior to the autumn of 2008, so I've used the in-work share of expenditure growth (roughly 50%) from that point.