Social insurance in a time of coronavirus: the problem of Statutory Sick Pay

At time of writing (25 June 2020) some 9.2 million employees have been furloughed from their jobs as part of the effort to combat coronavirus. Under the government’s Coronavirus Job Retention Scheme (CJRS) they are entitled to be paid 80% of their wages up to a monthly limit of £2,500, for which their employers are compensated by government. A similar compensation scheme is in operation for self-employed workers, with 2.6m claims as of 21 June. [Update 17 August 2020: note that these are cumulative totals from the introduction of these schemes, not the totals at any single point in time.]

However employees who are not on furlough and who are unable to work because they have symptoms of coronavirus, or because they have come into contact with someone infected and are obliged to self-isolate, or because they are shielding on government advice, are entitled not to a percentage of their previous wages but to Statutory Sick Pay, a flat-rate payment of £95.85 a week, equivalent to a mere 15% of the maximum available under the CJRS and to a little over a quarter of the full-time minimum wage. Some but not all employers are entitled to compensation for this payment. No statistics seem to be available at the moment for how many employees are receiving corona-related SSP.

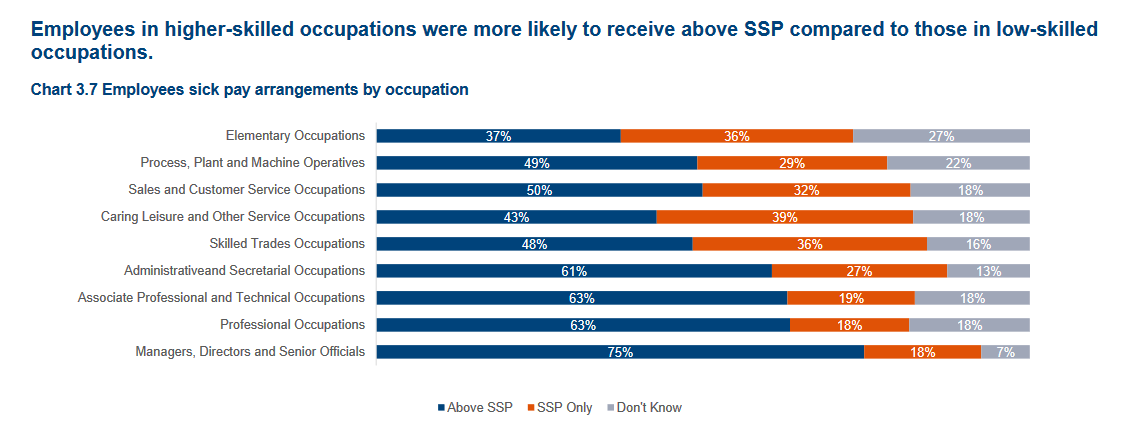

This difference in entitlements between workers on CJRS and those on SSP would seem to represent an obvious inequity in how the costs of the pandemic are distributed as a matter of policy - though probably not as a matter of conscious policy choice (see below). The prima facie inequity is compounded by the fact that some of the losers will be workers in essential services who can not work from home and have thus been obliged to take on greater risks of infection than the rest of the population. Some will receive more than the statutory minimum if their employer operates an occupational sick pay scheme, but this will not be the case for many and the pattern of entitlement to occupational schemes is tilted towards higher paid and more secure jobs (see chart).

Apart from these equity considerations, the disparity in entitlement has implications for compliance with the policy of self-isolation for those showing symptoms or who have come into contact with people infected with coronavirus. The effectiveness of this policy depends crucially on the judgement of individual workers, especially in the absence of a functioning track and trace system, and it can hardly be assumed that judgement under conditions of considerable uncertainty will be immune to influence from economic incentives. On the contrary, where compliance comes with a sizeable financial penalty it is to be expected that more workers will lean towards a looser interpretation of the guidance and a lower estimate of their risk of passing infection on. As lockdown measures are eased and more employers reopen this problem will become more rather than less pressing.

It is worth reflecting on how we got here: more by accident than design I think, but with the accidental element deriving from the longer term history of UK social security. A distinctive feature of the Beveridgean approach to social insurance was the use of flat-rate rather than earnings-related benefits (the idea being that better-off workers could build up personal provision through savings or private insurance). This contrasts with continental systems of earnings insurance where a percentage of previous earnings is covered, usually up to a relatively high upper threshold. The only major exception to the flat-rate approach until the pandemic was Statutory Maternity Pay (SMP), introduced in 1987, which is to all intents and purposes a continental style system of social insurance of earnings for the first six weeks of leave. When the government was looking for a way of avoiding large-scale layoffs in response to the pandemic, it adopted the SMP model: the CJRS is, detail aside, essentially SMP for the coronavirus. This makes sense not just because a lot of the necessary administrative infrastructure was already in place, but because both SMP and CJRS are aimed at maintaining continuity of employment rather than compensating for loss of employment or income.

Thus this part of the response to the pandemic has involved a remarkable if temporary switch towards a more continental approach to social insurance. The treatment of sickness on the other hand continues to rest on a flat-rate approach, and one that does not even merit the term ‘Beveridgean’ because the most basic principle of social insurance - risk-pooling across workers and firms- has been severely compromised. From its introduction, SSP functioned as an insurance scheme only for smaller employers, who were entitled to claim compensation from the National Insurance Fund, and even this was abandoned in 2015, since when the full cost of SSP has fallen on employers regardless of establishment size. With the pandemic, compensation for smaller employers was reintroduced. SSP is thus an odd hybrid, a regulatory imposition for all employers but an insurance scheme only for some, and there is no reason to expect even the existing residualised insurance element to survive the pandemic.

The point of this digression into welfare history is to put the response to the pandemic into a broader framework of social security policy. Functionally, CJRS is a scheme for the social insurance of earnings with risks pooled across firms and households (through general taxation rather than a separate stream of social contributions). If it resembles Statutory Maternity Pay, this is partly because both are retention benefits, designed to smooth incomes over interruptions to work in the context of a continuous employment relation and with both workers and employers benefiting from insurance. Statutory Sick Pay by contrast is primarily a regulatory requirement on firms with a hastily reintroduced and incomplete insurance function bolted on and offering very limited smoothing of income. This is hard to make sense of at the best of times: after all, SSP is also a retention benefit, so why doesn't it look more like SMP? But in the context of the pandemic, it is leading to disparities in treatment that seem particularly hard to justify on equity grounds and threaten to undermine efforts to control the virus. Sickness absence due to coronavirus is not a matter of individual discretion: it is the response required by government if you have symptoms (however severe) or have been in contact with someone with the virus. Under these circumstances, why should employees and employers not be comprehensively insured against this risk?

The obvious solution is to apply the SMP/CJRS model to Statutory Sick Pay for the duration of the crisis, with employees receiving 80% of earnings and firms compensated for the full value. The Treasury will baulk at deadweight costs and potential windfall gains for employers, employees and insurance companies, as is its job, but these considerations are considerably less persuasive at the moment –if the crisis proves relatively short-lived, the deadweight will be limited, if not, there will be weightier costs to worry about. The administrative infrastructure is in place. A temporary reform to SSP along these lines for an initial phase of three to six months is, to coin a phrase, ‘oven-ready’.

Of course some of these arguments for (in effect) aligning sick pay with maternity pay are not specific to the context of the pandemic, and it would be disingenuous to pretend otherwise. However if I were making the case for permanent reform this article would be a lot longer and would cover many other inadequacies in the current system.